Abstract

This article examines the recent financial misconduct allegations against the Jaggi brothers, co-founders of BluSmart and promoters of Gensol Engineering Ltd. The case highlights critical issues of corporate governance, financial transparency, and the erosion of investor trust. This analysis will discuss the incident within the framework of sound economic principles, focusing on the importance of a robust legal framework and ethical business practices for sustainable development.

1. Introduction

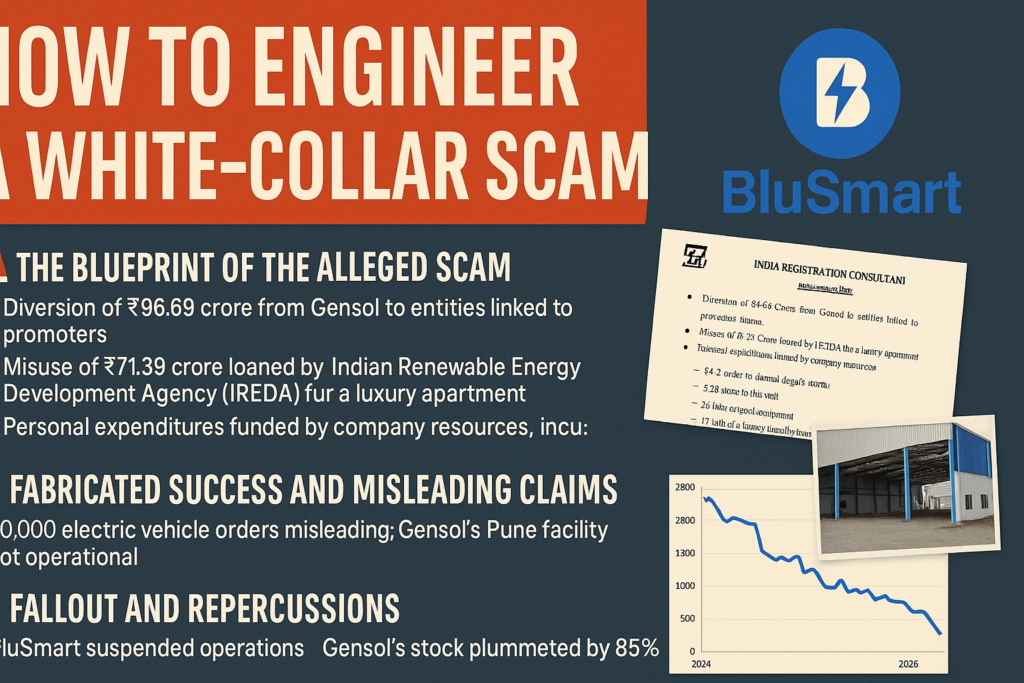

The Indian startup ecosystem, a burgeoning sector driving innovation and economic growth, has recently been shaken by allegations of financial misconduct involving Anmol and Puneet Jaggi, the co-founders of BluSmart and promoters of Gensol Engineering Ltd. The Securities and Exchange Board of India (SEBI) has levied serious charges against the Jaggi brothers, including fund misappropriation, misleading investors, and personal enrichment through company funds.

2. Allegations of Financial Misconduct

Read more: Corporate Malfeasance and the Erosion of Trust: A Case Study of the BluSmart-Gensol Debacle- Fund Diversion: SEBI alleges that ₹96.69 crore was diverted from Gensol to entities linked to the promoters.

- Misuse of Loans: ₹71.39 crore loaned by IREDA (Indian Renewable Energy Development Agency) for electric vehicle procurement was allegedly misdirected to purchase a luxury apartment.

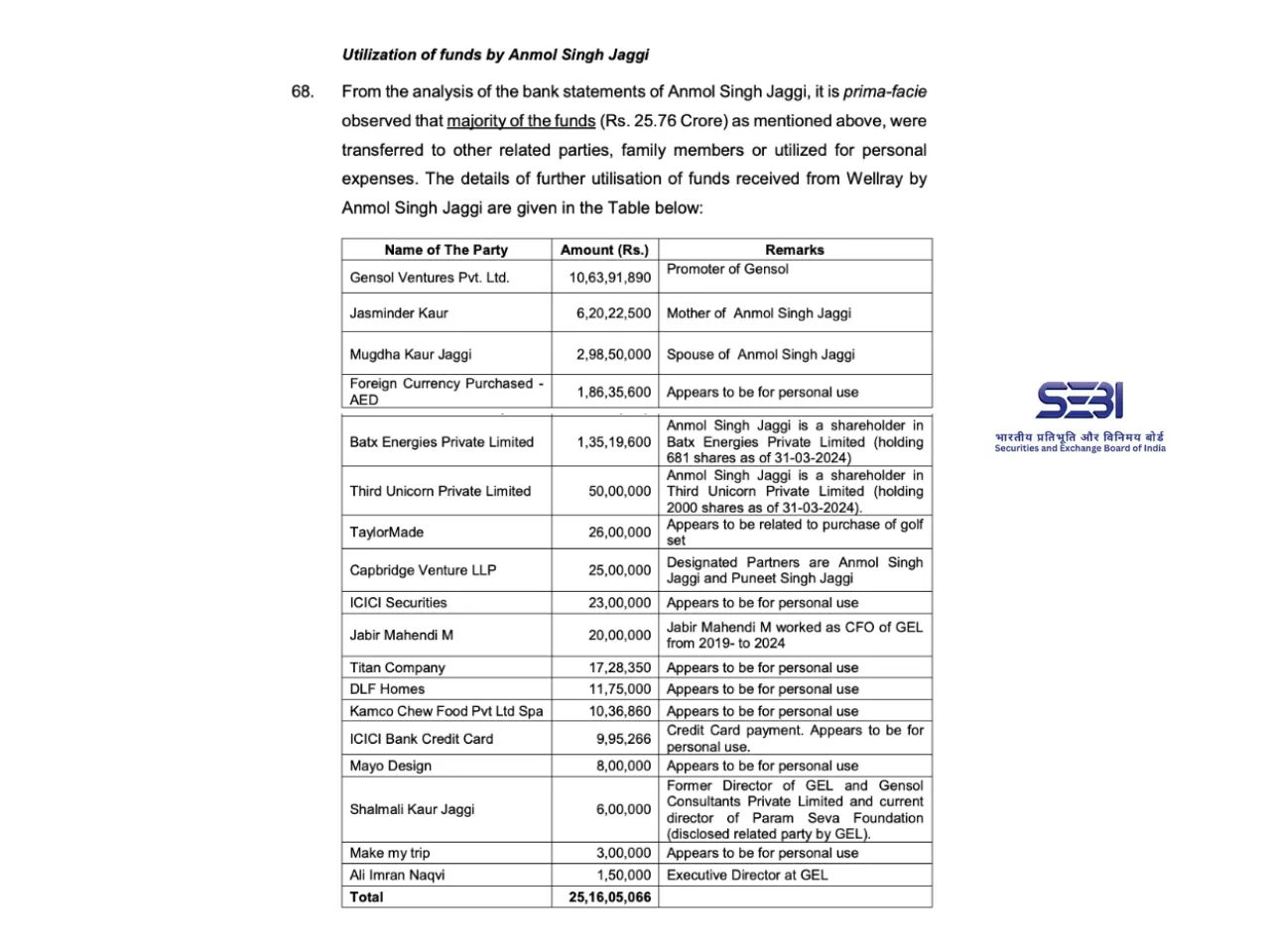

- Personal Expenditures: Company resources were allegedly used for personal expenses, including significant transfers to family members, foreign currency purchases, and luxury goods.

3. Misleading Claims and Fabricated Success

- Inflated Order Book: Gensol publicly claimed to have secured 30,000 electric vehicle orders. SEBI’s investigation revealed these were primarily non-binding expressions of interest, lacking concrete contractual agreements.

- Misrepresentation of Manufacturing Capabilities: Despite claiming active production, SEBI’s inspection found no active production at Gensol’s Pune manufacturing facility.

4. Fallout and Repercussions

- Operational Suspension: BluSmart suspended operations, impacting over 8,000 drivers and leaving thousands of electric taxis idle.

- Stock Plunge: Gensol’s stock plummeted by 85% in 2025, reflecting investor apprehension and eroding shareholder value.

- Credit Downgrades: Credit rating agencies downgraded Gensol’s ratings, citing concerns over liquidity and governance.

- Resignation of Independent Directors: Independent directors resigned from Gensol’s board, expressing dismay over governance failures.

5. Implications for Sound Economic Principles

- Rule of Law and Corporate Governance: The BluSmart-Gensol case underscores the critical importance of a robust legal framework and strong corporate governance practices for a healthy economic environment.

- Financial Transparency and Investor Protection: Maintaining financial transparency and safeguarding investor interests are crucial for fostering sustainable economic development.

- Ethical Business Conduct: Promoting ethical business practices and discouraging activities that undermine investor trust is essential for the long-term growth and stability of any economy.

- Sustainable Development: The case highlights the importance of aligning business practices with sustainable development goals, ensuring environmental and social responsibility.

6. Conclusion

The BluSmart-Gensol saga serves as a stark reminder of the consequences of corporate malfeasance. It emphasizes the need for a strong regulatory environment, adherence to ethical business practices, and a commitment to transparency and accountability. By upholding these principles, economies can foster a conducive environment for responsible business growth and sustainable development.